| • | | Business Leadership/Operations: Served seven years as CEO of Sempra. Over three decades of experience in senior management and executive positions at Sempra, including responsibility for utility and infrastructure operations. Environmental Affairs: As Chairman and CEO of Sempra, oversaw all aspects of Sempra’s environmental and sustainability policies and strategies, which include initiatives to address challenges like limiting water use, improving the quality and efficiency of operations, infrastructure development and access to energy, human health, and environmental safety.

Finance: Former Chairman and CEO of Fortune 500 company. More than a decade of financial responsibility and experience at Sempra. Former CFO of San Diego Gas & Electric and SoCalGas.

Global Business / International Affairs: Former Chairman and CEO of Fortune 500 company that conducts business in Mexico and South America. Current and former director of companies with international operations.

Government / Regulatory / Public Policy: At Sempra, worked with and adhered to the rules established by the California Public Utilities Commission, the principal regulator of Sempra’s California utilities. Served four years on the National Petroleum Council, a federally chartered advisory committee to the U.S. Secretary of Energy.

Science / Technology / Engineering: B.S. in civil engineering from the University of Southern California. Served in a variety of senior management and executive positions at Sempra, requiring expertise in engineering and technology. Director at Caterpillar, a manufacturer of construction and mining equipment, and Lockheed Martin, a global security and aerospace company.

| | | 14 | | Chevron Corporation—2021 Proxy Statement |

| | | | |  | | Ronald D. Sugar

RetiredEnvironmental Affairs: As Chairman and Chief Executive Officer, Northrop Grumman CorporationCEO of Sempra, oversaw all aspects of Sempra’s environmental and sustainability policies and strategies, which include initiatives to address challenges like limiting water use, improving the quality and efficiency of operations, infrastructure development and access to energy, human health, and environmental safety.

|

| • | | Finance: Former Chairman and CEO of a Fortune 500 company. More than a decade of financial responsibility and experience at Sempra or its subsidiaries. Former CFO of San Diego Gas & Electric and SoCalGas. Previously served as an Audit Committee member at Lockheed Martin. |

| • | | Global Business/International Affairs: Former Chairman and CEO of a Fortune 500 company that conducts business in Mexico and South America. Current and former director of companies with international operations. |

| • | | Government/Regulatory/Public Policy: At Sempra, worked with and adhered to the rules established by the California Public Utilities Commission, the principal regulator of Sempra’s California utilities. Served four years on the National Petroleum Council, a federally chartered advisory committee to the U.S. Secretary of Energy. |

| • | | Leading Business Transformation: As Chairman and CEO of Sempra, led transformation of San Diego Gas & Electric from all fossil fuel generation to becoming one of the utilities with the highest percentage of renewables in its portfolio. Also led creation of the second largest energy company in Mexico to facilitate Mexico’s transition to renewable energy, including development of infrastructure in Mexico to support that transition. |

| • | | Science/Technology/Engineering: B.S. in civil engineering from the University of Southern California and former member of the Board of Councilors at the University of Southern California’s Viterbi School of Engineering. Served in a variety of senior management and executive positions at Sempra, requiring expertise in engineering and technology. Director at Caterpillar, a manufacturer of construction and mining equipment, and Lockheed Martin, a global security and aerospace company. |

Director Insights Lead Director Since: 2015

| | | | | | | | Q | | How does the Board think about the role of acquisitions in supporting long-term strategy for Chevron? | | A | | “Chevron is a learning organization at heart, which makes us an exceptional acquirer since we take best practices and integrate them across our current and future businesses. Chevron’s acquisitions are strategic and focused on leveraging meaningful synergies.” |

Chevron Corporation 2024 Proxy Statement 18

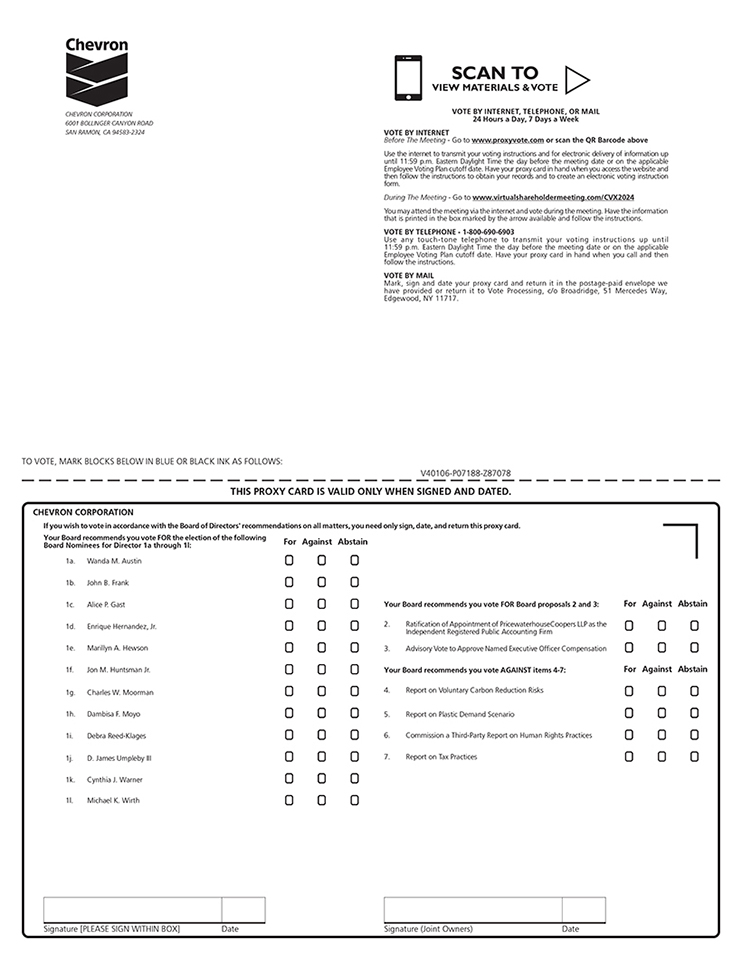

election of directors

| | | | | | | Age: 72

Director Since: April 2005

Independent: Yes

Chevron Committees:

• Board Nominating and Governance (Chair)

• Management Compensation

Current Public Company Directorships:

• Amgen Inc.

• Apple Inc.

• Uber Technologies, Inc.D. James Umpleby III | 66

| | Director Prior Public Company Directorships

(within last five years):

• Air Lease Corporation

Other Directorships and Memberships:

• Los Angeles Philharmonic Association

• National Academy of Engineering

• Nexli Building Solutions, Inc.

• UCLA Anderson School of Management Board of Visitors

• University of Southern California

|

Dr. Sugar is a senior advisor to various businesses and organizations, including Ares Management LLC, a private investment firm; Bain & Company, a global consulting firm; Temasek Americas Advisory Panel, a private investment company based in Singapore; and the G100 and World 50 peer-to-peer exchanges for current and former senior executives and directors from some of the world’s largest companies. He is also an advisor to Northrop Grumman Corporation (“Northrop Grumman”), a global aerospace and defense company, and was previously Northrop Grumman’s Chairman and Chief Executive Officer, from 2003 until his retirement in 2010, and President and Chief Operating Officer, from 2001 until 2003. He joined Northrop Grumman in 2001, having previously served as President and Chief Operating Officer of Litton Industries, Inc., a developer of military products, and earlier as an executive of TRW Inc., a developer of missile systems and spacecraft.

skills and qualifications

Business Leadership / Operations: Served seven years as CEO of Northrop Grumman. Held senior management and executive positions, including service as COO, at Northrop Grumman, Litton Industries, Inc., and TRW Inc.

Environmental Affairs: As Chairman, CEO, and President of Northrop Grumman, oversaw environmental assessments and remediations at shipyards and aircraft and electronics factories.

Finance: Former CFO of Fortune 500 company. More than three decades of financial responsibility and experience at Northrop Grumman, Litton Industries, Inc., and TRW Inc. Current Audit Committee Chair at Apple Inc. and former Audit Committee Chair at Chevron.

Global Business / International Affairs: Former CEO of Fortune 500 company with extensive international operations. Current and former director of companies with international operations.

Government / Regulatory / Public Policy: At Northrop Grumman, a key government contractor, oversaw development of weapons and other technologies. Appointed by the President of the United States to the National Security Telecommunications Advisory Committee. Former director of the World Affairs Council of Los Angeles.

Science / Technology / Engineering: B.S., M.S., and Ph.D. in engineering from the University of California at Los Angeles. Served in a variety of senior management and executive positions at Northrop Grumman, Litton Industries, Inc., and TRW Inc., requiring expertise in engineering and technology. Director at Amgen Inc., a biotechnology company; Apple Inc., a designer, manufacturer, and marketer of, among other things, personal computers and mobile communication and media devices; Uber Technologies, Inc., a technology company; and former director at BeyondTrust, a global cybersecurity company. Member of National Academy of Engineering.

| | | Chevron Corporation—2021 Proxy Statement | | 15 |

Chairman and CEO Caterpillar Inc. | | Director Since March 2018 | | Independent Yes | | | election of directors

Board Committees | | |

| | | | |  | | | | | D. James Umpleby III

Chairman and Chief Executive Officer, Caterpillar Inc.

Age: 63

Director Since: March 2018

Independent: Yes

Chevron Committees:

• Board Nominating and Governance

• Management CompensationGovernance; Public Policy and Sustainability

| | |

| | | | | Current Public Company Directorships:Directorships • Caterpillar Inc. Prior Public Company Directorships (within past five years) • None | | Prior Public Company Directorships

(within last five years):

• None

Other Directorships and Memberships:Memberships • Business Roundtable •Roundtable; The Business Council

•Council; National Petroleum Council

•Council; Peterson Institute for International Economics

•Economics; Rose-Hulman Institute of Technology

•Technology; U.S.-China Business Council

•Council; U.S.-India Strategic Partnership Forum

| |

|

Mr. Umpleby has been Chairman since 2018, and Chief Executive Officer since 2017, of

Professional Experience

Caterpillar Inc. (“Caterpillar”), a leading manufacturer of construction and mining equipment, diesel, and natural gas engines, industrial gas turbines, and diesel-electric locomotives. He was locomotives Chairman (since 2018); CEO (since 2017) Group President of Caterpillar from 2013 until 2016, with responsibility for Caterpillar’s energy and transportationthe Energy & Transportation business segment and (2013–2016) Vice President from 2010 to 2013. He joined Solar Turbines Incorporated, now a Caterpillar subsidiary, in 1980 as an associate engineer.(2010–2013) skillsSkills and qualificationsExperience Supporting Nomination

Business Leadership / Operations:

| • | | Business Leadership/Operations: Chairman and CEO of a Fortune 100 company. More than three decades of experience in senior management and executive positions at Caterpillar, including responsibility for engineering, manufacturing, marketing, sales, and services. Environmental Affairs: As Chairman and CEO of Caterpillar, oversees all aspects of Caterpillar’s environmental and sustainability policies and strategies, which include initiatives to address challenges like preventing waste, improving the quality and efficiency of operations, developing infrastructure, and ensuring access to energy, human health, and environmental safety. Served as a member of the Latin America Conservation Council, in partnership with The Nature Conservancy, a global conservation organization. Former director of the World Resources Institute, an international research nonprofit organization working to secure a sustainable future.

Finance: Chairman and CEO of Fortune 100 company. More than a decade of financial responsibility and experience at Caterpillar.

Global Business / International Affairs: Chairman and CEO of Fortune 100 company with extensive international operations. Served in assignments at Caterpillar in Singapore and Kuala Lumpur from 1984 to 1990. Director of the Peterson Institute for International Economics, the U.S.-China Business Council, and the U.S.-India Business Strategic Partnership Forum and a former member of the U.S.-India CEO Forum.

Science / Technology / Engineering: B.S. in Mechanical Engineering from the Rose-Hulman Institute of Technology. Has served in a variety of senior management and executive positions at Caterpillar, requiring expertise in engineering and technology.

| | | 16 | | Chevron Corporation—2021 Proxy Statement |

| | | | |  | | Michael K. Wirth

Environmental Affairs: As Chairman and Chief Executive Officer,CEO of Caterpillar, oversees all aspects of Caterpillar’s environmental and sustainability policies and strategies, which include initiatives to address challenges like preventing waste, improving the quality and efficiency of operations, developing infrastructure, and ensuring access to energy, human health, and environmental safety. Served as a member of the Latin America Conservation Council, in partnership with The Nature Conservancy, a global conservation organization. Former Director of the World Resources Institute, an international research nonprofit organization working to secure a sustainable future. |

| • | | Finance: Chairman and CEO of a Fortune 100 company. More than a decade of financial responsibility and experience at Caterpillar. |

| • | | Global Business/International Affairs: Chairman and CEO of a Fortune 100 company with extensive international operations. Served in assignments at Caterpillar in Singapore and Kuala Lumpur from 1984 to 1990. Director of the Peterson Institute for International Economics, the U.S.-China Business Council, and the U.S.-India Business Strategic Partnership Forum and a former member of the U.S.-India CEO Forum. |

| • | | Leading Business Transformation: As Chairman and CEO of Caterpillar, developed a new strategy for long-term profitable growth. Leads a global team that is implementing the strategy focused on operational excellence, expanded offerings, sustainability, and services. Accelerated expansion of commercial offerings to provide additional customer value, growing total sales and revenue over 70% since becoming CEO in 2017. In alignment with the strategy, drove enterprisewide improvement of operational performance with deployment of the Caterpillar Operating & Execution Model across the company to prioritize resource allocation for long-term profitable growth. In 2023, Caterpillar achieved record full-year adjusted profit per share, which has increased more than six fold during his tenure as CEO. |

| • | | Science/Technology/Engineering: B.S. in mechanical engineering from the Rose-Hulman Institute of Technology. Has served in a variety of senior management and executive positions at Caterpillar, requiring expertise in engineering and technology. |

Director Insights | | | | | | | | Q | | What areas of Chevron’s strategy do you feel investors should be focused on in the coming years? | | A | | “Investors should note Chevron’s ability to produce cash across the macroeconomic cycle, which has allowed Chevron to reward our stockholders with predictable dividend growth and a robust share buyback program.” |

Chevron Corporation 2024 Proxy Statement 19

election of directors

| | | | | | | | | Cynthia J. Warner | 65 | | Director | | | Former President and CEO Renewable Energy Group, Inc. | | Director Since June 2022 | | Independent Yes |

| | Board Committees | | | | | | | Public Policy and Sustainability

|

| | | | |

| | Current Public Company Directorships • Sempra; Bloom Energy Prior Public Company Directorships (within past five years) • Renewable Energy Group, Inc.; IDEX Corporation | | Age: 60

Director Since: February 2017

Independent: NoOther Directorships and Memberships

• Trustee of the Committee for Economic Development; member of the National Petroleum Council; Board of Advisors of Vanderbilt University School of Engineering; member of the Executive Committee of the Board of Advisors of Columbia University Center on Global Energy Policy; Board of Trustee of the University of the Incarnate Word |

Professional Experience

GVP Climate, a venture capital firm that focuses on early-stage clean technology Senior Operating Partner (since 2023) Renewable Energy Group, Inc. (“Renewable Energy Group”), a global producer and supplier of bio-based diesel President, CEO, and Director (2019–2022) Andeavor (formerly Tesoro Corporation), an integrated marketing, logistics, and refining company Executive Vice President, Operations (2016–2018); Executive Vice President, Strategy and Business Development (2014–2016) Sapphire Energy, a biofuels company Chairman and CEO (2012–2014); Chairman and President (2009–2011) BP (British Petroleum), a multinational oil and gas company Group Vice President of Global Refining (2007–2009); Group Vice President of Health, Safety, Security, Environmental and Technology (2005–2007) Skills and Experience Supporting Nomination | • | | Business Leadership/Operations: Over 40 years of business leadership experience in the traditional and renewable energy sectors, holding key roles in technology development, operations, business development, strategy, environment, health, and safety. Named a Fortune 2020 Businessperson of the Year. |

| • | | Environmental Affairs: More than 35 years of experience in the traditional and renewable energy sectors with an extensive background in refining and its health, safety, security, and environmental operations and efforts. Led the groundbreaking cooperative effort with the U.S. Environmental Protection Agency to shape a framework for clean air improvements, to which the entire U.S. refining industry eventually signed on. Senior Operating Partner at GVP Climate, a venture capital firm seeking to invest in early-stage firms with technologies that will help to foster a transition to a lower carbon system. |

| • | | Finance: More than a decade of financial responsibility and experience at Sapphire Energy, Andeavor/Marathon, and Renewable Energy Group. |

| • | | Global Business/International Affairs: Former CEO of an international company that produces and supplies renewable fuels like biodiesel and renewable diesel, renewable chemicals, and other products. Current and former director of companies with international operations. Worked and resided internationally for over 10 years, including having responsibility for operations of refineries and pipeline systems in five continents. |

| • | | Leading Business Transformation: Developed and executed a strategy to grow Renewable Energy Group’s value delivery by over three times in three years; spearheaded significant growth at Andeavor, including acquisition of Western Refining and purchase and conversion of the Dickinson refinery to a renewable diesel plant; oversaw implementation of a multifaceted operations management system for BP’s entire refining system; led award-winning effort to improve union/management relationships at the Amoco Texas City refinery. |

| • | | Science/Technology/Engineering: B.S. in chemical engineering from Vanderbilt University. Served as process development engineer and internal process technology consultant at Amoco Oil Company for over a decade. As CEO of Sapphire Energy, oversaw development of technology to produce oil from algae, successfully building and placing into operation one of the largest algae farms in the world. Currently serving on the Board of Advisors of Vanderbilt University School of Engineering and appointed to its Academy of Distinguished Alumni in 2019. |

Director Insights | | | | | | | | Q | | Are there any notable ways in which the Board has evolved over your tenure as a Director? | | A | | “The Chevron Committees:Board is collectively inquisitive and learning-oriented. This fosters a culture of continual growth and deeper understanding of — and appreciation for — the challenges and opportunities the Company is facing.” |

Chevron Corporation 2024 Proxy Statement 20

election of directors

| | | | | | | Michael K. (Mike) Wirth | 63 | | Chairman Since February 2018 | | | Chairman and CEO Chevron Corporation | | Director Since February 2017 | | Independent No | | | Board Committees | | | | | | | None

| | |

| | | | | Current Public Company Directorships • None CurrentPrior Public Company Directorships:Directorships (within past five years)

• None | | Prior Public CompanyOther Directorships

(within last five years): and Memberships

• None Other DirectorshipsMember of the Board of Directors of American Petroleum Institute and Memberships:

•Catalyst; member of the National Petroleum Council, the Business Roundtable, the World Economic Forum International Business Council, the American Heart Association CEO Roundtable,

• American Petroleum Institute

• The Business Council, and the American Society of Corporate Executives

| | • The Business Council

• Business Roundtable

• Catalyst

• International Business Council of the World Economic Forum

• National Petroleum Council

|

Mr. Wirth has been

Professional Experience

Chevron Chairman and Chief Executive Officer of Chevron since February 2018. He was CEO (since 2018) Vice Chairman in 2017 andof the Board (2017–2018); Executive Vice President of Midstream & Development from 2016 until 2018, where he was responsible for supply and trading, shipping, pipeline, and power operating units; corporate strategy; business development; and policy, government, and public affairs. He served as(2016–2018); Executive Vice President of Downstream & Chemicals from 2006 to 2015. From 2003 until 2006, Mr. Wirth was(2006–2015); President of Global Supply & Trading. Mr. Wirth joinedand Trading (2003–2006) Joined Chevron in 1982. skills and qualifications

Business Leadership / Operations: Chairman and CEO of Chevron. Twelve years as Executive Vice President of Chevron. More than three decades of experience in senior management and executive positions at Chevron.

Environmental Affairs: As Chairman and CEO of Chevron, oversees all aspects of Chevron’s environmental policies and strategies. Oversaw environmental policies and strategies of Chevron’s Downstream & Chemicals and shipping and pipeline operations.

Finance: CEO of Fortune 100 company. More than a decade of financial responsibility and experience at Chevron.

Global Business / International Affairs: Chairman and CEO of Fortune 100 company with extensive international operations. Served as President of Marketing for Chevron’s Asia/Middle East/Africa marketing business based in Singapore and served as director of Caltex Australia Ltd. and GS Caltex in South Korea.

Government / Regulatory / Public Policy: More than three decades of experience in highly regulated industry. As Chairman and CEO of Chevron, oversees all aspects of Chevron’s government, regulatory, and public policy affairs.

Science / Technology / Engineering: B.S. in Chemical Engineering from the University of Colorado. More than three decades of experience at Chevron. Joined as a design engineer in 1982

Skills and Experience Supporting Nomination | • | | Business Leadership/Operations: Chairman and CEO of Chevron. Twelve years as Executive Vice President of Chevron. More than three decades of experience in senior management and executive positions at Chevron. |

| • | | Environmental Affairs: As Chairman and CEO of Chevron, oversees all aspects of Chevron’s environmental policies and strategies. Oversaw environmental policies and strategies of Chevron’s Downstream & Chemicals and shipping and pipeline operations. |

| • | | Finance: CEO of a Fortune 100 company. More than a decade of financial responsibility and experience at Chevron. |

| • | | Global Business/International Affairs: Chairman and CEO of a Fortune 100 company with extensive international operations. Served as President of Marketing for Chevron’s Asia/Middle East/Africa marketing business based in Singapore and served as director of Caltex Australia Ltd. and GS Caltex in South Korea. |

| • | | Government/Regulatory/Public Policy: More than three decades of experience in a highly regulated industry. As Chairman and CEO of Chevron, oversees all aspects of Chevron’s government, regulatory, and public policy affairs. |

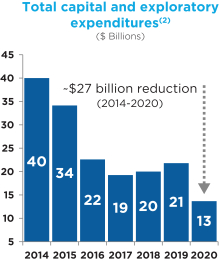

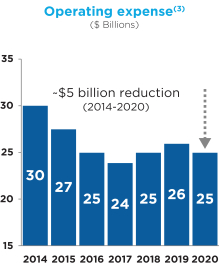

| • | | Leading Business Transformation: From 2010 to 2012, led the major turnaround of Chevron’s global Downstream & Chemicals business, including significant portfolio rationalization, new supply chain processes, manufacturing improvements, and comprehensive organizational restructuring. Cost savings, margin growth, and execution improvement drove a significant shift in relative competitive performance on safety, reliability, and profitability. In 2019 and 2020, led transformation of Chevron Corporation, including the largest corporate restructuring in more than two decades. Approach was comprehensive and addressed strategy, portfolio business model, culture, and efficiency. Completed a major acquisition at the same time. |

| • | | Science/Technology/Engineering: B.S. in chemical engineering from the University of Colorado. More than three decades of experience at Chevron. Joined as a design engineer and advanced through a number of engineering, construction, marketing, and operations roles. |

Director Insights | | | | | | | | Q | | Which Chevron facility visit over the past two years has enhanced your perspective of Chevron, and how? | | A | | “Our visit to our operations in Colorado was a great opportunity for the Board to witness the benefits of the acquisition of Noble Energy in addition to the then-pending acquisition of PDC Energy. It also provided opportunities to learn more about innovation in development of lower carbon-intensity production.” |

Chevron Corporation 2024 Proxy Statement 21

election of directors director orientation and education Chevron’s Board maintains a new Director orientation program that is preferably completed during a new Director’s first year of Board service. The orientation program has three main components: (1) written materials detailing information about Chevron, such as Chevron’s governing documents, recent U.S. Securities and Exchange Commission (“SEC”) filings, and press releases; (2) a series of meetings with Chevron’s senior executives; and (3) Chevron facility/site visits to experience Chevron’s operations in person (visits include a Downstream facility, typically a refinery, and an upstream operation). Beyond orientation, Directors regularly visit Chevron work locations to meet with employees and learn about particular operations. Directors are provided with a list of continuing director education opportunities, and all Directors are encouraged to periodically attend director continuing education programs offered by various organizations. In addition, Directors benefit from access to various governance and directorship organizations and publications to which Chevron subscribes. Directors also receive a weekly digest of news articles related to Chevron and ongoing education through a number of engineering, construction, marketing,Board briefings and operations roles.presentations on various topics at Board and Committee meetings, which regularly include outside speakers. vote required Each Director nominee who receives a majority of the votes cast (i.e., the number of shares voted FOR a Director nominee must exceed the number of shares voted AGAINST that Director nominee, excluding abstentions) will be elected a Director in an uncontested election. Any shares not voted (whether by abstention or otherwise) will have no impact on the elections. If you are a street name stockholder and do not vote your shares, your bank, broker, or other holder of record cannot vote your shares at its discretion in these elections. If the number of Director nominees exceeds the number of Directors to be elected—elected — a circumstance we do not anticipate—anticipate — the Directors shall be elected by a plurality of the shares present in person or by proxy at the Annual Meeting, or any adjournment or postponement thereof, and entitled to vote on the election of Directors. your board’s recommendation Your Board recommends that you vote FOR each of the 12 Director nominees named in this Proxy Statement. | | | Chevron Corporation—2021Chevron Corporation 2024 Proxy Statement | | 17 |

22

overviewdirector compensation

objectives Our compensationCompensation for our non-employee Directors is designed to be competitive with compensation for directors of other large, global energy companies and other large, capital-intensive, international companies; to link rewards to business results and stockholder returns; and to align stockholder and Director interests through increased Director ownership of Chevron common stock. We do not have a retirement plan for non-employee Directors. Our Chief Executive Officer is not paid additional compensation for service as a Director.

The Governance Committee evaluates and recommends to the non-employee Directors of the Board the compensation for non-employee Directors, and the non-employee Directors of the Board approve the compensation. Our executive officers have no role in determining the amount or form of non-employee Director compensation.overview

In 2020, the Governance Committee retained the services of an independent compensation consultant, Pearl Meyer & Partners, LLC (“Pearl Meyer”), to assist the Governance Committee with its periodic

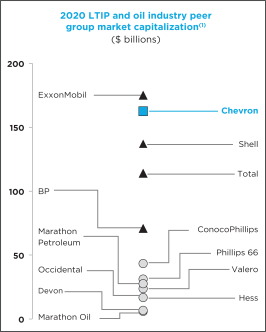

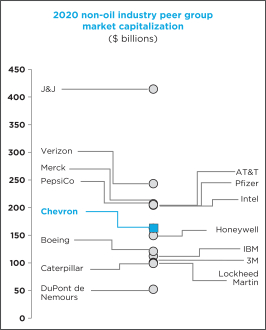

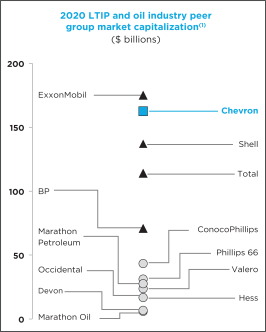

review of Chevron’s non-employee Director compensation program relative to Chevron’s 2020 Oil Industry Peer Group and 2020 Non-Oil Industry Peer Group (excluding Devon for the 2020 Oil Industry Peer Group and DuPont de Nemours for the 2020 Non-Oil Industry Peer Group), as identified in “use of peer groups” in the “compensation discussion and analysis” section of this Proxy Statement.

Based on this review, the Governance Committee recommended, and the non-employee Directors of the Board agreed, that no changes should be made to Director compensation in 2021.

Pearl Meyer and its lead consultant report directly to the Governance Committee under the terms of the engagement, but they may work cooperatively with management to develop analyses and proposals when requested to do so by the Governance Committee. Pearl Meyer does not provide any services to the Company.

non-employee director compensation

In 2020, each non-employee Director received annual compensation of $375,000, with 40 percent paid in cash (or stock options at the Director’s election) and 60 percent paid in restricted stock units (“RSUs”). An additional cash retainer, in the amounts described below, is paid to the Lead Director and each Committee Chair. Directors do not receive fees for attending Board or Board Committee meetings, nor do they receive fees for meeting with stockholders. Under the Chevron Corporation Non-Employee Directors’ Equity Compensation and Deferral Plan, as amended, and Plan Rules, as amended (together, the “NED Plan”), Chevron’s Annual Compensation Cycle for its non-employee Directors is the period commencing on the day of the Annual Meeting at which the non-employeeDirector is elected through the day immediately preceding the next Annual Meeting.

Our non-employee Director compensation program consists primarily of a cash component and an equity component. Non-employee Directors do not receive fees for attending Board or Committee meetings, nor do they receive fees for meeting with stockholders. We do not provide non-equity incentive awards, nor do we provide a retirement plan for non-employee Directors. | | | | | | | Position | | Cash Retainer(1) | | | RSUs(2) | Non-Employee Director | | $ | 150,000 | | | $225,000 | Lead Director | | $ | 30,000 | | | – | Audit Committee Chair | | $ | 30,000 | | | – | Board Nominating and Governance Committee Chair | | $ | 20,000 | | | – | Management Compensation Committee Chair | | $ | 25,000 | | | – | Public Policy and Sustainability Committee Chair | | $ | 20,000 | | | – |

Our Chief Executive Officer is not paid additional compensation for service as a Director. (1) | Each cash retainer is paid in monthly installments beginning with the date the Director is elected to the Board. Under the NED Plan, Directors can elect to receive nonstatutory/nonqualified stock options instead of any portion of their cash compensation. Directors can also elect to defer receipt of any portion of their cash compensation. Deferral elections must be made by December 31 in the year preceding the year in which the cash to be deferred is earned. Deferrals are credited, at the Director’s election, into accounts tracked with reference to the same investment fund options available to participants in the Chevron Deferred Compensation Plan, including a Chevron Common Stock Fund. Distribution of deferred amounts is in cash except for amounts valued with reference to the Chevron Common Stock Fund, which are distributed in shares of Chevron common stock.

|

cash retainer (2) | RSUs are granted on the date of the Annual Meeting at which the Director is elected. If a Director is elected to the Board between annual meetings, a prorated grant is made. RSUs are paid out in shares of Chevron common stock unless the Director has elected to defer the payout until retirement. RSUs are subject to forfeiture (except when the Director dies, reaches mandatory retirement age of 74, becomes disabled, changes primary occupation, or enters government service) until the earlier of 12 months or the day preceding the first Annual Meeting following the date of the grant.

|

The non-employee Directors of the Board approved an increase in non-employee Director compensation, effective as of the 2023 Annual Meeting, as described in last year’s Proxy Statement. As a result, non-employee Directors received total annual compensation of $390,000 per non-employee Director, with approximately 40%, or $155,000, paid in cash and approximately 60%, or $235,000, paid in restricted stock units (“RSUs”). In line with historical practice, an additional cash retainer, in the amounts described herein, was paid to the independent Lead Director and each Committee Chair. Each cash retainer is paid in monthly installments beginning with the date the non-employee Director is elected to the Board. Under the NED Plan, non-employee Directors can elect to defer receipt of any portion of their cash compensation. Deferral elections must be made by December 31 in the year preceding the year in which the cash to be deferred is earned. Deferrals are credited, at the non-employee Director’s election, into accounts tracked with reference to the same investment fund options available to participants in the Chevron Deferred Compensation Plan II, including a Chevron Stock Fund. None of the earnings under the NED Plan are above market or preferential. Distribution of deferred amounts is in cash except for amounts valued with reference to the Chevron Stock Fund, which are distributed in shares of Chevron common stock. equity compensation RSUs are granted on the date of the Annual Meeting at which the non-employee Director is elected. If a non-employee Director is elected to the Board between annual meetings, a prorated grant is made. RSUs are paid out in shares of Chevron common stock unless the non-employee Director has elected to defer the payout until retirement. RSUs are subject to forfeiture (except when the non-employee Director dies, reaches mandatory retirement age of 74, becomes disabled, changes primary occupation, or enters government service) until the earlier of 12 months or the day preceding the first Annual Meeting following the date of the grant, at which time they vest. expenses and charitable matching gift program Non-employee Directors are reimbursed for out-of-pocket expenses incurred in connection with the business and affairs of Chevron. Non-employee Directors are eligible to participate in Chevron Humankind, our charitable matching gift and community involvement program, which is available to any employee, retiree, orand Director. For active employees andnon-employee Directors, we match contributions to eligible entities and grants for volunteer time, up to a maximum of $10,000 per year. | | | 18 | | Chevron Corporation—2021 Proxy Statement |

Chevron Corporation 2024 Proxy Statement 23

director compensation governance The Governance Committee evaluates and recommends to the Board the compensation for non-employee Directors, and the Board approves the compensation. Our executive officers have no role in determining the amount or form of non-employee Director compensation. The Committee may retain the services of an independent compensation consultant to assist the Committee with its work. The Committee did not do so in 2023. director stock ownership guidelines Under the Corporate Governance Guidelines, each non-employee Director is expected, within five years of when the Director first becomes subject to the guidelines, to own shares of Chevron common stock that have a value equal to seven times their annual cash retainer, or 15,000 shares, for serving as a Director. Shares may be owned directly by the individual, owned jointly with, or separately by, the Director’s spouse, or held in trust for the benefit of the Director, the Director’s spouse, or the Director’s children. All non-employee Directors with more than five years of service have met our stock ownership guidelines, and all non-employee Directors with less than five years of service have met or are on target to meet our stock ownership guidelines within the expected time. Chevron Corporation 2024 Proxy Statement 24

director compensation 2023 non-employee director compensation The 2023 non-employee Directors’ annual compensation, and the additional annual cash retainer for the independent Lead Director and each Board Committee Chair, are described below. | | | | | | | Position | | Cash retainer | | | RSUs | | | | Non-Employee Director | | $ | 155,000 | | | $235,000 | | | | Independent Lead Director | | $ | 50,000 | | | — | | | | Audit Committee Chair | | $ | 30,000 | | | — | | | | Board Nominating and Governance Committee Chair | | $ | 20,000 | | | — | | | | Management Compensation Committee Chair | | $ | 25,000 | | | — | | | | Public Policy and Sustainability Committee Chair | | $ | 20,000 | | | — |

compensation during the fiscal year ended december 31, 20202023 The following table sets forth the compensation of our non-employee Directors for the fiscal year ended December 31, 2020.2023. | Name | | Fees earned or

paid in cash ($)(1) | | Stock

awards ($)(2) | | Option

awards ($)(3) | | All other

compensation ($)(4) | | Total ($) | | | Fees earned or

paid in cash

($) | | Stock

awards

($)(1) | | All other

compensation

($)(2) | | Total ($) | | | | Wanda M. Austin | | | — | | | $ | 225,000 | | | $ | 170,000 | (5) | | $ | 10,654 | | | $ | 405,654 | | Wanda M. Austin | | | $222,500(3)(4) | | $235,000 | | $10,000 | | $467,500 | | | | John B. Frank | | $ | 93,750 | (6)(7) | | $ | 225,000 | | | $ | 37,500 | | | $ | 10,654 | | | $ | 366,904 | | John B. Frank | | | $152,500(5) | | $235,000 | | $10,000 | | $397,500 | | | | Alice P. Gast | | $ | 150,000 | (6) | | $ | 225,000 | | | | — | | | $ | 654 | | | $ | 375,654 | | Alice P. Gast | | | $152,500(5) | | $235,000 | | $28,581 | | $416,081 | | | | Enrique Hernandez, Jr. | | $ | 87,500 | (5)(7)(8) | | $ | 225,000 | | | | — | | | $ | 10,654 | | | $ | 323,154 | | Marillyn A. Hewson(9) | | | — | | | | — | | | | — | | | | — | | | | — | | Jon M. Huntsman Jr.(10) | | $ | 29,258 | | | $ | 156,387 | | | | — | | | $ | 179 | | | $ | 185,824 | | Charles W. Moorman IV | | $ | 45,000 | (5)(6)(7) | | $ | 225,000 | | | $ | 90,000 | (5) | | $ | 10,654 | | | $ | 370,654 | | Enrique Hernandez, Jr. | | | $172,500(3) | | $235,000 | | $10,000 | | $417,500 | | | | Marillyn A. Hewson | | Marillyn A. Hewson | | | $152,500(5) | | $235,000 | | $10,000 | | $397,500 | | | | Jon M. Huntsman Jr. | | Jon M. Huntsman Jr. | | | $152,500 | | $235,000 | | —

| | $387,500 | | | | Charles W. Moorman | | Charles W. Moorman | | | $177,500(3)(5) | | $235,000 | | $10,000 | | $422,500 | | | | Dambisa F. Moyo | | $ | 150,000 | | | $ | 225,000 | | | | — | | | $ | 654 | | | $ | 375,654 | | Dambisa F. Moyo | | | $152,500 | | $235,000 | | —

| | $387,500 | | | | Debra Reed-Klages | | $ | 150,000 | (6) | | $ | 225,000 | | | | — | | | $ | 654 | | | $ | 375,654 | | Debra Reed-Klages | | | $182,500(3) | | $235,000 | | —

| | $417,500 | | | | Ronald D. Sugar | | $ | 200,000 | (5)(6)(11) | | $ | 225,000 | | | | — | | | $ | 10,654 | | | $ | 435,654 | | Inge G. Thulin | | $ | 12,500 | (12) | | | — | | | | — | | | | — | | | $ | 12,500 | | Ronald D. Sugar | | | $ 75,000(5)(6) | | — | | $15,751

| | $ 90,751 | | | | D. James Umpleby III | | $ | 150,000 | (6) | | $ | 225,000 | | | | — | | | $ | 654 | | | $ | 375,654 | | D. James Umpleby III | | | $152,500(5) | | $235,000 | | $10,000 | | $397,500 | | | | Cynthia J. Warner | | Cynthia J. Warner | | | $152,500(5) | | $235,000 | | $10,000 | | $397,500 | | |

Chevron Corporation 2024 Proxy Statement 25

director compensation | (1) | Form of compensation elected by a Director, as described above, can result in differences in reportable compensation.

|

(2) | Amounts reflect the aggregate grant date fair value for RSUs granted in 20202023 under the NED Plan. We calculate the grant date fair value of these awards in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Compensation–Stock Compensation (“ASC Topic 718”), for financial reporting purposes. The grant date fair value of these RSUs was $93.30$153.12 per unit, the closing price of Chevron common stock on May 26, 2020, except for the prorated award for Gov. Huntsman. For Gov. Huntsman, the grant date fair value of these RSUs was $76.35 per unit, the closing price of Chevron common stock on September 15, 2020, the day he joined the Board. Gov. Huntsman received a prorated grant of 2,048 RSUs for the compensation period covering September 15, 2020, through May 25, 2021.30, 2023. RSUs accrue dividend equivalents, the value of which is factored into the grant date fair value.value, and vest on the earlier of 12 months or the day preceding the first Annual Meeting following the date of the grant. For purposes of this table only, estimates of forfeitures related to service-based vesting conditions for awards have been disregarded. RSUs are payable in Chevron common stock. |

At December 31, 2020, the following Directors had the following number of shares subject to outstanding stock awards or deferrals:

| At December 31, 2023, the following non-employee Directors had the following number of shares subject to outstanding stock awards, deferrals, or stock options: |

| Name | | Restricted

stock(a) | | Stock units(a) | | RSUs(a) | | Stock units from

Director’s

deferral of cash

retainer(b) | | Total | | | Stock

units(a) | | RSUs(a) | | Stock units

from Director’s

deferral of

cash retainer(b) | | Stock

options(c) | | Total | | Wanda M. Austin | | | – | | | | – | | | 2,485 | | | | – | | | 2,485 | | Wanda M. Austin | | Wanda M. Austin | | Wanda M. Austin | | Wanda M. Austin | | | | | — | | | | | 1,565 | | | | | — | | | | | — | | | | | 1,565 | | | John B. Frank | | | – | | | | – | | | 7,906 | | | | – | | | 7,906 | | John B. Frank | | John B. Frank | | John B. Frank | | John B. Frank | | | | | — | | | | | 14,251 | | | | | — | | | | | 14,413 | | | | | 28,664 | | | Alice P. Gast | | | – | | | | – | | | 17,062 | | | | – | | | 17,062 | | Alice P. Gast | | Alice P. Gast | | Alice P. Gast | | Alice P. Gast | | | | | — | | | | | 24,584 | | | | | — | | | | | — | | | | | 24,584 | | | Enrique Hernandez, Jr. | | | – | | | | – | | | 19,586 | | | 1,369 | | | 20,955 | | Enrique Hernandez, Jr. | | Enrique Hernandez, Jr. | | Enrique Hernandez, Jr. | | Enrique Hernandez, Jr. | | | | | — | | | | | 27,431 | | | | | 1,544 | | | | | — | | | | | 28,975 | | | Marillyn A. Hewson | | | – | | | | – | | | | – | | | | – | | | | – | | Marillyn A. Hewson | | Marillyn A. Hewson | | Marillyn A. Hewson | | Marillyn A. Hewson | | | | | — | | | | | 6,527 | | | | | 3,233 | | | �� | | — | | | | | 9,760 | | | Jon M. Huntsman Jr. | | | – | | | | – | | | 2,076 | | | | – | | | 2,076 | | Charles W. Moorman IV | | | – | | | | – | | | 22,089 | | | 11,095 | | | 33,184 | | Jon M. Huntsman Jr. | | Jon M. Huntsman Jr. | | Jon M. Huntsman Jr. | | Jon M. Huntsman Jr. | | | | | — | | | | | 1,565 | | | | | — | | | | | — | | | | | 1,565 | | | Charles W. Moorman | | Charles W. Moorman | | Charles W. Moorman | | Charles W. Moorman | | Charles W. Moorman | | | | | — | | | | | 30,256 | | | | | 16,107 | | | | | 28,809 | | | | | 75,172 | | | Dambisa F. Moyo | | | – | | | | – | | | 2,485 | | | | – | | | 2,485 | | Dambisa F. Moyo | | Dambisa F. Moyo | | Dambisa F. Moyo | | Dambisa F. Moyo | | | | | — | | | | | 5,329 | | | | | — | | | | | — | | | | | 5,329 | | | Debra Reed-Klages | | | – | | | | – | | | 5,564 | | | 1,099 | | | 6,663 | | Debra Reed-Klages | | Debra Reed-Klages | | Debra Reed-Klages | | Debra Reed-Klages | | | | | — | | | | | 11,608 | | | | | 1,240 | | | | | — | | | | | 12,848 | | | Ronald D. Sugar | | 2,811 | | | 8,603 | | | 39,526 | | | 17,710 | | | 68,650 | | Inge G. Thulin | | | – | | | | – | | | 11,016 | | | 648 | | | 11,664 | | Ronald D. Sugar | | Ronald D. Sugar | | Ronald D. Sugar | | Ronald D. Sugar | | | | | 9,708 | | | | | 48,368 | | | | | 19,984 | | | | | — | | | | | 78,060 | | | D. James Umpleby III | | | – | | | | – | | | | 2,485 | | | | – | | | | 2,485 | | D. James Umpleby III | | D. James Umpleby III | | D. James Umpleby III | | D. James Umpleby III | | | | | — | | | | | 1,565 | | | | | — | | | | | — | | | | | 1,565 | | | Cynthia J. Warner | | Cynthia J. Warner | | Cynthia J. Warner | | Cynthia J. Warner | | Cynthia J. Warner | | | | | — | | | | | 2,913 | | | | | 133 | | | | | — | | | | | 3,046 | |

| | (a) | Represents awards of restricted stock and dividends and stock units and dividend equivalents from 2005 through 2006 and awards of RSUs and dividend equivalents beginning in 2007, rounded to whole units. Awards of restricted stock are fully vested and are settled in shares of Chevron common stock upon retirement. Awards of stock units and deferred RSUs are settled in shares of Chevron common stock in either one or 10 annual installments following the Director’s retirement, resignation, or death. RSUs not deferred are settled in shares upon vesting on the earlier of 12 months or the day preceding the first Annual Meeting following the date of the grant. The terms of awards of RSUs are described above. |

| | (b) | Represents deferred compensation and dividend equivalents, rounded to whole units. Distribution will be made in either one or 10 annual installments. Any deferred amounts unpaid at the time of a Director’s death are distributed to the Director’s beneficiary. |

(3) | (c) | ForRepresents nonstatutory/nonqualified stock options awarded under the NED Plan prior to December 31, 2021. Effective December 31, 2021, non-employee Directors electingmay no longer elect to receive stock options in lieu of all or a portiontheir cash retainer. Any outstanding stock options previously granted remain outstanding under the terms of the annual cash retainer,original grant until the stock options are granted on the date of the Annual Meeting at which the Director is elected, with 50 percent vested on November 27, 2020, and 50 percent vesting on May 25, 2021. The aggregate grant date fair value is being reported as compensation in 2020, the year of grant, notwithstanding the Annual Compensation Cycle covering the period from May 27, 2020, through May 25, 2021. exercised or expire.

|

| | The stock options are exercisable for that number of shares of Chevron common stock determined by dividing the amount of the cash retainer subject to the election by the Black-Scholes value of a stock option on the date of grant. Elections to receive stock options in lieu of any portion of cash compensation must be made by December 31 in the year preceding the year in which the stock options are granted. The stock options have an exercise price based on the closing price of Chevron common stock on the date of grant. |

| Amounts reported here reflect the aggregate grant date fair value for stock options granted on May 27, 2020. The grant date fair value was determined in accordance with ASC Topic 718 for financial reporting purposes. The grant date fair value of each option is calculated using the Black-Scholes model. Stock options granted on May 27, 2020, have an exercise

|

| | | Chevron Corporation—2021 Proxy Statement | | 19 |

| price of $93.90 and a grant date fair value of $14.12. The assumptions used in the Black-Scholes model to calculate this grant date fair value were: an expected life of 6.6 years, a volatility rate of 29.3 percent, a risk-free interest rate of 0.48 percent, and a dividend yield of 4.71 percent. For purposes of this table only, estimates of forfeitures related to service-based vesting conditions have been disregarded.

|

| Dr. Austin and Messrs. Frank and Moorman each elected to receive all or a part of their 2020 annual cash compensation in the form of stock options. The number of stock options granted in 2020 was 12,039 to Dr. Austin, 2,655 to Mr. Frank, and 6,373 to Mr. Moorman. One-half of the stock options vested on November 27, 2020, and the remaining half vests on May 25, 2021. Stock options expire after 10 years.

|

| At December 31, 2020, Dr. Austin had 23,471, Mr. Frank had 12,003, and Mr. Moorman had 28,809 outstanding, vested and unvested stock options. Under the NED Plan,Non-employee Directors who retire in accordance with Chevron’s Director Retirement Policy have until 10 years from the date of grant to exercise any outstanding options. Stock options do not accrue dividends or dividend equivalents.

|

Chevron Corporation 2024 Proxy Statement 26

director compensation (4)(2) | All Other Compensation for 20202023 includes the following items: |

| Name | | Insurance(a) | | Perquisites(b) | | Charitable(c) | | Perquisites(a) | | Charitable(b) | | Wanda M. Austin | | $ 654 | | – | | $ 10,000 | Wanda M. Austin | | | —

| | $10,000 | | John B. Frank | | $ 654 | | – | | $ 10,000 | John B. Frank | | | —

| | $10,000 | | Alice P. Gast | | $ 654 | | – | | – | Alice P. Gast | | | $18,581 | | $10,000 | | Enrique Hernandez, Jr. | | $ 654 | | – | | $ 10,000 | Enrique Hernandez, Jr. | | | —

| | $10,000 | | Marillyn A. Hewson | | – | | – | | – | Marillyn A. Hewson | | | —

| | $10,000 | | Jon M. Huntsman Jr. | | $ 179 | | – | | – | Charles W. Moorman IV | | $ 654 | | – | | $ 10,000 | Jon M. Huntsman Jr. | | | —

| | —

| | Charles W. Moorman | | Charles W. Moorman | | | —

| | $10,000 | | Dambisa F. Moyo | | $ 654 | | – | | – | Dambisa F. Moyo | | | —

| | —

| | Debra Reed-Klages | | $ 654 | | – | | – | Debra Reed-Klages | | | —

| | —

| | Ronald D. Sugar | | $ 654 | | – | | $ 10,000 | Inge G. Thulin | | – | | – | | – | Ronald D. Sugar | | | $15,751

| | —

| | D. James Umpleby III | | $ 654 | | – | | – | D. James Umpleby III | | | —

| | $10,000 | | Cynthia J. Warner | | Cynthia J. Warner | | | —

| | $10,000 |

| | (a) | Amounts reflectReflects perquisites and personal benefits received by a Director in 2023 to the annualized premiumextent that the total value of such perquisites and personal benefits was equal to or exceeded $10,000. For Drs. Gast and Sugar, amount includes expenses for accidental deaththe actual aggregate incremental cost incurred in connection with spousal attendance at a company event, including transportation and dismemberment insurance coverage paid by Chevron.meals. The amount for Dr. Sugar also includes the value of gifts presented upon his retirement. A holiday gift was given to each Director.

|

| | (b) | Perquisites and personal benefits did not equal or exceed $10,000 for any Director in 2020.

|

| (c) | Amounts reflect payments made to charitable organizations under Chevron Humankind, our charitable matching gift and community involvement program, to match donations made by the non-employeeDirectors in 2020.2023. |

(5)(3) | Amount includes the additional retainer paid for serving as a Board Committee Chair during 2020.2023. |

(6)(4) | Amount includes the additional cash retainer paid for serving as Lead Director during 2023. |

| (5) | Director has elected to defer all or a portion of the cash retainer under the NED Plan in 2020. None of the earnings under the NED Plan are above market or preferential.2023. |

(7)(6) | Messrs. Frank, Hernandez, and Moorman each elected to receive all or a portion of his 2020 cash retainer coveringDr. Sugar retired from the period from January 1, 2020, throughBoard on May 26, 2020, in the 2019 Annual Compensation Cycle in stock options in lieu of cash. Accordingly, all or a portion of the cash retainer was reported as compensation in 2019.31, 2023.

|

(8) | Reflects Mr. Hernandez’s cash retainer covering the period from May 27, 2020, through December 31, 2020.

|

(9) | Ms. Hewson joined the Board on January 1, 2021; therefore, she received no compensation in 2020.

|

(10) | Gov. Huntsman joined the Board on September 15, 2020.

|

(11) | Amount includes the additional cash retainer paid for serving as Lead Director during 2020.

|

(12) | Mr. Thulin resigned from the Board effective January 1, 2020. Reflects Mr. Thulin’s cash retainer paid in January 2020 for his service as a Director for the period December 1, 2019, through December 31, 2019.

|

| | | 20 | | Chevron Corporation—2021Chevron Corporation 2024 Proxy Statement |

27

overview

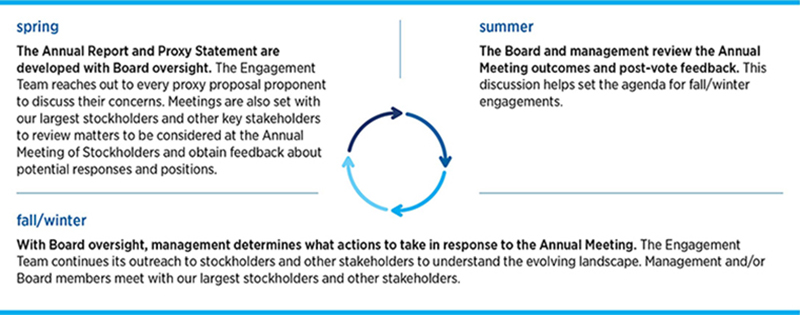

overview Chevron is governed by a Board of Directors and Board Committees that meet throughout the year. Directors discharge their responsibilities at Board and Committee meetings and through other communications with management. Your Board is committed to strong corporate governance structures and practices that help Chevron compete more effectively, sustain its success, and build long-termlong- term stockholder value. role of the board of directors YourThe Board oversees and provides guidance for Chevron’s business and affairs. The Boardaffairs and oversees management’s development and implementation of Chevron’s strategy and business planning process. The Board monitors corporate performance, the integrity of Chevron’s financial controls, and the effectiveness of its legal compliance and enterprise risk management programs. This is generally a year-round

process, culminating in Board reviews of Chevron’s strategic plan, its business plan, the next year’s capital expenditures budget, and key financial and operational indicators. YourThe Board also oversees management and the succession of key executives. corporate governance guidelines Your Board has adopted Corporate Governance Guidelines to provide a transparent framework for the effective governance of Chevron. The Corporate Governance Guidelines are reviewed regularly and updated as appropriate. The full text of the Corporate Governance Guidelines can be found on our website at www.chevron.com/investors/corporate-governance. The guidelines address, among other topics: Role of the Board Board succession planning and membership criteria Director independence Board size Director terms of office Election of Directors Other Board memberships Director retirement policy Number and composition of Board Committees Board leadership and Lead Director Executive sessions Business Conduct and Ethics Code Confidentiality Succession planning Board compensation Board access to management and other employees Director orientation and education Evaluation of Board performance Chief Executive Officer performance review Director and officer stock ownership guidelines Access to outside advisors Board agenda and meetings Chevron Corporation 2024 Proxy Statement 28

corporate governance board leadership structure Under Chevron’s By-Laws, the positions of Chairman of the Board and Chief Executive Officer are separate positions that may be occupied by the same person at the discretion of the Board. Chevron’s independent Directors select the Chairman of the Board annually. Thus, the Board has great flexibility to choose its optimal leadership structure depending upon Chevron’s particular needs and circumstances and to organize its functions and conduct its business in the most effective manner. Annually, the Governance Committee conducts an assessment of Chevron’s corporate governance structures and processes, which includes a review of Chevron’s Board leadership structure and whether combining or separating the roles of Chairman and CEO is in the best interests of Chevron’s stockholders. At present, Chevron’s Board believes that it is in the stockholders’ best interests for the CEO, Michael K. Wirth, to also serve as Chairman of the Board. The Board believes that having Mr. Wirth serve as Chairman fosters an important unity of leadership between the Board and management that is subject to effective oversight by the independent Lead Director and the other independent Directors. The Board believes that it benefits from the significant knowledge, insight, and perspective of Chevron and the energy industry that Mr. Wirth has gained throughout his 3841 years with Chevron. Our business is highly complex, and our projects often have long lead times, with many of our major capital projects taking more than 10 years from the exploration phase to first production. The Board believes that Mr. Wirth’s in-depth knowledge of the Company, coupled with his extensive industry expertise, makes him particularly qualified to lead discussions of the Board.Board discussions. Having Mr. Wirth serve as Chairman also promotes better alignment of Chevron’s long-term strategic development with its operational execution. Also, as a global energy company that negotiates concessions and leases with host-country governments around the world, it is advantageous to the Company for the CEO to represent the Chevron Board in such dialogues as its Chairman. Significantly, the Board does not believe that combining the roles creates ambiguity about reporting relationships. GivenThe independent Directors believe it is clear that Mr. Wirth reports to and is accountable to the independent Directors, given the role of the independent Lead Director discussed below and the fact that the independent Directors, pursuant to their powers under the By-Laws, have affirmatively selected Mr. Wirth for the positions of Chairman and CEO, annually set his compensation, and regularly evaluate his performance, the Board believes it is clear that Mr. Wirth reports and is accountable to the independent Directors.performance. Moreover, the Board does not believe that having the CEO also serve as Chairman inhibits the flow of information and interactions betweenamong the Board, management, and other Company personnel. To the contrary, the Board has unfettered access to management and other Company employees, and the Board believes that having Mr. Wirth in the roles of both Chairman and CEO facilitates the flow of information and communications between the Board and management, which enhances the Board’s ability to obtain information and to monitor management. | | | Chevron Corporation—2021 Proxy Statement | | 21 |

independent lead director Your Board recognizes the importance of independent Board oversight of the CEO and management and has developed policies and procedures designed to ensure independent oversight. In addition to conducting an annual review of the CEO’s performance, the independent Directors meet in executive session at each regular Board meeting, andduring which they discuss management’s performance and routinely formulate guidance and feedback, which the independent Lead Director provides to the CEO and other members of management. Further, when the Board selects the CEO to also serve as Chairman, the independent Directors annually select an independent Lead Director, currently Dr. Sugar.Austin. The Board routinely reviews the Lead Director’s responsibilities to ensure that these responsibilities enhance its independent oversight of the CEO and management and the flow of information and interactions betweenamong the Board, management, and other Company personnel. Annually the Lead Director leads the independent Directors’ review of candidates for all senior management positions. This succession planning process includes consideration ofplanning for both ordinary course succession, in the event of planned promotions and retirements, and planning for situations wherein which the CEO or another member of senior management unexpectedly becomes unable to perform the duties of their positions. The Lead Director and the Chairman collaborate closely on Board meeting schedules, and agendas, and information provided to the Board. These consultations andschedules, agendas, and the information provided to the Board frequently reflect input and suggestions from other members of the Board and management. You can read more about these particular processes in the “Board Agenda and Meetings” section of Chevron’s Corporate Governance Guidelines. Any stockholder can communicate with the Lead Director or any of the other Directors in the manner described in the “Communicating with With the Board” section of this Proxy Statement. Chevron Corporation 2024 Proxy Statement 29

corporate governance As described in the “Board Leadership and Lead Director” section of Chevron’s Corporate Governance Guidelines, the Lead Director’s responsibilities are to: Chair all meetings of the Board in the Chairman’s absence; Chair the executive sessions; | • | | Lead non-employee Directors in an annual discussion of the performance evaluation of the CEO as well as communicate that evaluation to the CEO; |

Oversee the process for CEO succession planning; Lead the Board’s review of the Governance Committee’s assessment and recommendations from the Board self-evaluation process; Lead the individual Director evaluation process; Serve as liaison between the Chairman and the independent Directors; Consult with the Chairman on and approve agendas and schedules for Board meetings and other matters pertinent to the Corporation and the Board; Be available to advise the Committee Chairs in fulfilling their designated roles and responsibilities; Participate in the interview process for prospective directors with the Governance Committee; Call meetings of the independent Directors and special meetings of the Board; and Be available as appropriate for consultation and direct communication with major stockholders. Also, as discussed in more detail in the “Environmental, Social, and Governance“Year-Round Stockholder Engagement” section of this Proxy Statement, the Board encourages a robust investor engagement program. During these engagements, Board leadership is a frequent topic of discussion. In general, investors, including those who are philosophically opposed to combining the positions of Chairman and CEO, have overwhelmingly communicated to Chevron that they have minimal, if any, concerns about your Board or individual Directors or about Chevron’s policies and leadership structure. More specifically, these investors have voiced confidence in the strong counterbalancing structure of the robust independent Lead Director role. Dr. Austin has participated in engagements with our largest stockholders on multiple occasions over the past five years. Chevron Corporation 2024 Proxy Statement 30

corporate governance director independence | | | Your Board has determined that each Director who served in 2023 (Drs. Austin, Gast, and Sugar, Mses. Hewson, Moyo, Reed-Klages, and Warner, and Messrs. Frank, Hernandez, Huntsman, Moorman, and Umpleby), except for Mr. Wirth, is independent in accordance with the NYSE Corporate Governance Standards and that no material relationship exists with Chevron other than as a Director. |

For a Director to be considered independent, the Board must determine that the Director does not have any material relationship with Chevron, other than as a Director. In making its determinations, the Board adheres to the specific tests for independence included in the NYSE Corporate Governance Standards. In addition, the Board has determined that the following relationships of Chevron Directors occurring within the last fiscal year are categorically immaterial to a determination of independence if the relevant transaction was conducted in the ordinary course of business: A director of another entity if business transactions between Chevron and that entity do not exceed $5 million or 5% of the receiving entity’s consolidated gross revenues, whichever is greater; An employee of another entity if business transactions in the most recent fiscal year between Chevron and that entity do not exceed $250,000 or 0.5% of the receiving entity’s consolidated gross revenues for that year, whichever is greater; A director of another entity if Chevron’s discretionary charitable contributions to that entity do not exceed $1 million or 2% of that entity’s gross revenues, whichever is greater, and if the charitable contributions are consistent with Chevron’s philanthropic practices; and A relationship arising solely from a Director’s ownership of an equity or limited partnership interest in a party that engages in a transaction with Chevron as long as the Director’s ownership interest does not exceed 2% of the total equity or partnership interest in that other party. These categorical standards are contained in our Corporate Governance Guidelines, which are available on our website at www.chevron.com/investors/corporate-governance and are available in print upon request. Chevron Corporation 2024 Proxy Statement 31

corporate governance board committees Chevron’s Board of Directors has four standing Committees: Audit; Board Nominating and Governance; Management Compensation; and Public Policy and Sustainability. The Audit, Board Nominating and Governance, and Management Compensation Committees are each constituted and operated according to the independence and other requirements of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and the NYSE Corporate Governance Standards. Each independent Director, including each member of the Management Compensation Committee, is a “non-employee” director under the SEC rules related to Section 16 reporting. In addition, each member of the Audit Committee is financially literate and an “audit committee financial expert,” as such terms are defined under the NYSE Corporate Governance Standards and the Exchange Act and related rules. Each Committee is chaired by an independent Director who determines the agenda, the frequency, and the length of the meetings and who has unlimited access to management, information, and outside advisors, as necessary. Each non-employee Director generally serves on one or two Committees. Committee members serve staggered terms, enabling Directors to rotate periodically to different Committees. Four- to six-year terms for Committee Chairs facilitate rotation of Committee Chairs while preserving experienced leadership. Each Committee operates under a written charter that sets forth the purposes and responsibilities of the Committee as well as qualifications for Committee membership. Each Committee assesses the adequacy of its charter periodically and recommends changes to the Governance Committee. All Committees report regularly to the full Board of Directors with respect to their activities. Committee charters can be viewed on Chevron’s website at www.chevron.com/investors/corporate-governance. board and committee meetings and attendance In 2023, your Board held six regular Board meetings and four special Board meetings, with each regular meeting including an executive session of independent Directors led by our independent Lead Director. In addition, 24 Committee meetings were held in 2023, which included nine Audit Committee, six Governance Committee, four Management Compensation Committee, and four Public Policy and Sustainability Committee meetings, and one joint meeting of the Governance and the Public Policy and Sustainability Committees. All Directors attended at least 95% of their Board and Committee meetings in 2023. Chevron’s policy regarding Director attendance at the Annual Meeting, as described in the “Board Agenda and Meetings” section of Chevron’s Corporate Governance Guidelines (available at www.chevron.com/investors/corporate-governance), is that all Directors are expected to attend the Annual Meeting, absent extenuating circumstances. All Directors attended the 2023 Annual Meeting. board and committee evaluations Each year, your Board and its Committees perform a rigorous and comprehensive self-evaluation of the Board, Board Committees, and individual Directors to assess effectiveness and identify specific areas for improvement. As required by Chevron’s Corporate Governance Guidelines, the Governance Committee oversees this process, which includes the following: Each Director completes a performance evaluation providing detailed and anonymous input and identifying specific areas for improvement regarding the performance and effectiveness of the Board, the Board Committees, and individual Directors. For a more rigorous evaluation of individual Director performance, each Director completes a separate performance evaluation of each independent Director and submits the evaluations to outside counsel retained by the Company at the Governance Committee’s request. Outside counsel compiles the results of the evaluations into an individualized report on each independent Director, which are sent to the Lead Director for consideration and action as appropriate (the Chair of the Audit Committee receives the report on the Lead Director). The Lead Director meets individually with each independent Director to review the report prepared by outside counsel and provides feedback (the Chair of the Audit Committee meets with the Lead Director to review the report on the Lead Director). The Lead Director also uses these meetings to obtain further insight into matters relating to the Board and Board Committee evaluations. The Governance Committee reviews the results and feedback from the Board and Board Committee evaluation process and makes recommendations to the Board for improvements, as appropriate. The independent Lead Director leads a discussion of the evaluation results during an executive session of the Board and communicates relevant feedback to the CEO. Your Board has successfully used this process to evaluate Board, Committee, and individual Director effectiveness, and to identify opportunities to strengthen the Board. Chevron Corporation 2024 Proxy Statement 32

corporate governance audit committee summary Purpose: The Audit Committee assists your Board in fulfilling its responsibility to provide independent, objective oversight of Chevron’s financial reporting and internal control processes. | | | | | | | | | | | | | | | | |

As described

Debra Reed-Klages (Chair) | |

John B. Frank | |

Marillyn A. Hewson | |

Dambisa F. Moyo | | | | Independence: Each member is independent

under the NYSE Corporate Governance

Standards and SEC rules Financial expert: Each member is “financially

literate” and an “audit committee financial

expert,” as such terms are defined under the

NYSE Corporate Governance Standards and

the Exchange Act and related rules | | |

committee charter: www.chevron.com/investors/corporate-governance/audit-committee committee meetings held in 2023: 9 committee functions: Selects the independent registered public accounting firm for endorsement by the Board and ratification by the stockholders Reviews reports of the independent registered public accounting firm and internal auditors | • | | Reviews and approves the scope and cost of all services (including non-audit services) provided by the independent registered public accounting firm |

Monitors the effectiveness of the audit process and financial reporting Monitors the maintenance of an effective internal audit function Reviews the adequacy of accounting, internal control, auditing, and financial reporting matters Monitors implementation and effectiveness of Chevron’s compliance policies and procedures Assists the Board in fulfilling its oversight of enterprise risk management, particularly financial risks, including, but not limited to, financial risk exposures related to cybersecurity, and sustainability and climate change risks, and Chevron’s Operational Excellence audit and assurance process Evaluates the effectiveness of the Audit Committee committee oversight of risk: Assists the Board in fulfilling its oversight of accounting and financial reporting processes, including the audits and integrity of Chevron’s financial statements; financial risk exposures (including tax) as part of Chevron’s broad enterprise management program; Chevron’s Operational Excellence (“OE”) audit and assurance process; the qualifications, performance, and independence of the independent auditor; the effectiveness of internal controls over financial reporting; and the implementation and effectiveness of Chevron’s compliance programs and Internal Audit function Meets with and reviews reports from Chevron’s independent registered public accounting firm and internal auditors Discusses Chevron’s policies with respect to financial risk assessment and financial risk management, including, but not limited to, cybersecurity and sustainability and climate change risks Meets with Chevron’s Chief Compliance Officer and certain members of Chevron’s Compliance Policy Committee to | | receive information regarding compliance policies and procedures and internal controls |

Meets with Chevron’s Chief Information Officer and Chief Information Security Officer at least twice a year to review cybersecurity implications and risk management on financial exposures Meets with Chevron’s General Manager who oversees OE audit and assurance at least once a year to review findings of OE audits and corrective actions being taken to address priority findings Meets with Chevron’s General Counsel to review significant litigation matters Meets with Chevron’s General Tax Counsel to review significant tax matters Reports its discussions to the full Board for consideration and action when appropriate Chevron Corporation 2024 Proxy Statement 33

corporate governance board nominating and governance committee summary Purpose: The Board Nominating and Governance Committee is responsible for recommending to the Board qualified Director candidates for consideration, assisting the Board in organizing itself to discharge its duties and responsibilities, and providing oversight of Chevron’s governance practices and policies. | | | | | | | | | | | | | | | | |

Wanda M. Austin (Chair) | |

Alice P. Gast | |

Charles W.

Moorman | |

D. James Umpleby III | | | | Independence: Each member is independent

under the NYSE Corporate Governance

Standards | | |

committee charter: www.chevron.com/investors/corporate-governance/board-nominating-governance committee meetings held in 2023: 7 committee functions: Evaluates the effectiveness of the Board and its Committees and recommends changes to improve Board, Board Committee, and individual Director effectiveness Assesses the size and composition of the Board to evaluate the skills and experience that are currently represented, as well as the skills and characteristics that the Board may find valuable in the future, including, but not limited to, diversity, business leadership, finance, policy, and environmental and climate change experience Engages in succession planning for the Board and key leadership roles on the Board and its Committees Recommends prospective Director nominees Oversees the orientation process for new Directors and ongoing education for Directors | • | | Reviews and approves non-employee Director compensation |

| • | | Evaluates and recommends changes as appropriate in the “Board Leadership and Lead Director” section of Chevron’s Corporate Governance Guidelines, the Lead Director’s responsibilities are to:Restated Certificate of Incorporation, By-Laws, and other Board- adopted governance provisions |

Assesses stock ownership guidelines for Directors and the Directors’ ownership relative to the guidelines Reviews stockholder proposals and recommends (in conjunction with the Public Policy and Sustainability Committee) Board responses to proposals Assists the Board in fulfilling its oversight of enterprise risk management, particularly risks in connection with Chevron’s corporate governance practices and processes Evaluates the effectiveness of the Governance Committee committee oversight of risk: Assists the Board in fulfilling its oversight of risks that may arise in connection with Chevron’s governance practices and processes Conducts an annual evaluation of Chevron’s governance practices with the help of the Corporate Governance Department Discusses risk management in the context of general governance matters, including topics such as Board succession planning to ensure desired skills and attributes are represented, including, but not limited to, diversity, business leadership, finance, policy, and environmental and climate | | change experience; Board and individual Director assessment; delegations of authority and internal approval processes; stockholder proposals and activism; and Director and officer liability insurance |

In conjunction with the Public Policy and Sustainability Committee, oversees Chevron’s stockholder engagement program and makes recommendations regarding stockholder engagement Reports its discussions to the full Board for consideration and action when appropriate Chevron Corporation 2024 Proxy Statement 34

corporate governance management compensation committee summary Purpose: The Management Compensation Committee assists the Board in overseeing the Company’s executive compensation strategy and governance, compensation philosophy, policies, design, and administration to allow for executive attraction, retention, diversity, and alignment with stockholder interests. | | | | | | | | | | | | | | | | |

• chair all meetings of the Board in the Chairman’s absence;Charles W.

Moorman (Chair) | |

• chair the executive sessions;Wanda M.

Austin

| |

• lead non-management Directors in an annual discussion of the performance evaluation of the CEO as well as communicate that evaluation to the CEO;Enrique

Hernandez, Jr. | |

• overseeJon M.

Huntsman Jr. | | | | Independence: Each member is

independent under the process for CEO succession planning;NYSE Corporate

Governance Standards | | |